Corporate Governance continues to be an important area of focus for the Board. The Board believes that good Corporate Governance is essential for the long term success of the business and this is ultimately the responsibility of the Board and its Committees. The Board is delighted to report that during 2024, OXB was in full compliance with the UK Corporate Governance Code 2018 and good progress was made to comply with all the provisions of UK Corporate Governance Code 2024 which came into effect on 1 January 2025. The Board is working closely with the management to stay informed about the progress being made on changes to compliance with provision 29 of the UK Corporate Governance Code 2024 which comes into effect on 1 January 2026.

A copy of the code is available from the Financial Reporting Council’s website at www.frc.org.uk.

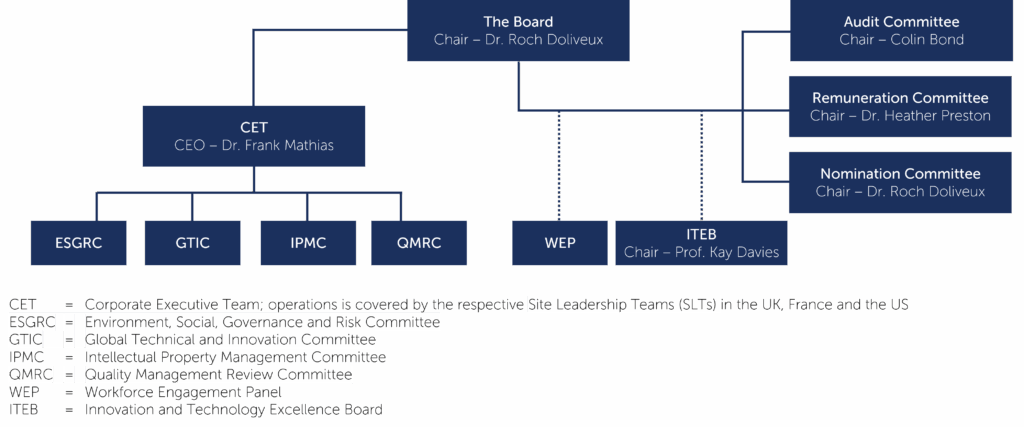

The current governance framework comprised of the Board and the Corporate Executive Team, and their respective sub-committees, is set out below:

Further information regarding governance at OXB can be found in our 2024 Annual Report.

The Board

The Board is collectively responsible for promoting the success of the Group by directing and supervising the Group’s activities to create shareholder value. In doing so, it ensures that there are robust corporate governance and risk management processes in place. The Board comprises both Non-Executive and Executive Directors and provides the forum for external and independent review and challenge to the executive management.

The Board’s powers and responsibilities are set out in the Company’s articles of association and it maintains and periodically reviews a formal schedule of matters reserved for the Board’s approval. Matters that have not been expressly reserved to the Board are delegated to the Chief Executive Officer or one of the three Board Committees.

The Board also takes a close interest in Innovation, Quality, Health and Safety, ESG and Risk Management. Each of these areas prepare reports for the Board ahead of each Board meeting.

Details of the matters reserved to the Board, Role of the Chair, the Vice Chair, the Chief Executive Officer and the Senior Independent Director can be accessed via the following links:

- Matters Reserved to the Board

- Role of the Chair

- Role of the Vice Chair

- Role of the CEO

- Role of the Senior Independent Director

Factoring Stakeholder Engagement into Board Decisions

By thoroughly understanding the Group’s key stakeholder groups, the Group can factor stakeholder needs and concerns into Boardroom discussions (further information on the Group’s stakeholders can be found on pages 27-33 of the 2024 Annual Report).

A stakeholder mapping was initiated during the year and it was concluded that the current stakeholders are correctly identified and remain relevant to the business. The Board considers the impact on all stakeholder groups when making material decisions. The stakeholder impact analysis assists the Directors in performing their duties under s172 of the Companies Act 2006 and provides the Board with assurance that the potential impacts on its stakeholders are being carefully considered by management when developing plans for Board approval.

The stakeholder impact analysis identifies:

• Potential benefits and areas of concern for each stakeholder group.

• The procedures and plans being implemented to mitigate against any areas of concern.

• Who is responsible for ensuring the mitigation plans are being effectively implemented.

By way of an example, the recently announced Group values and OXB branding illustrates how the Board considers all stakeholder groups in making decisions in accordance with s172 of the Companies Act 2006. Further details of the Board’s consideration of how the new Group values and OXB branding may affect stakeholders can be found in the Stakeholder case study section on pages 34-35 of the 2024 Annual Report.

Board Committees

Certain responsibilities are delegated to three Board Committees – the Audit, Nomination and Remuneration Committees. In addition, the Company also has an advisory committee, the Innovation and Technology Excellence Board. These Committees operate under clearly defined terms of reference. Further details can be found on the Board Committees page.

The Group also has an established WEP comprising employees from all levels and functions across the Group.

Upon joining the Company, induction meetings are arranged with Executive Directors, CET members and Site Heads. In addition, each Director is introduced to the Company’s corporate brokers and lawyers and provided with details of the duties and responsibilities of a director of a Company listed on the Main Market of the London Stock Exchange, the Market Abuse Regulation, Insider and PDMR dealing rules and the Bribery Act 2010, amongst other things.

All Directors of the Board and its Committees have access to advice and the services of the Company Secretary and to external professional advisers as required. The appointment and removal of the Company Secretary is a matter for the Board as a whole to consider.

Board Meetings

The Board meets regularly with the meeting dates agreed for each year in advance. In addition to the regular Board meetings, the Board (or an appointed sub-committee of the Board) also meets on a number of other occasions to consider other ad hoc matters such as the approval of financial statements and the interim financial results.

The Chair holds meetings after each regular Board meeting with Non-Executive Directors, without the Executive Directors in attendance.

The Chair sets the agenda for the Board meeting in consultation with the Chief Executive Officer and the Company Secretary. Board papers, covering the agenda and taking into account items relating to the Board’s responsibilities under s172 of the Companies Act 2006, are circulated several days ahead of each meeting. Regular Board papers during 2024 covered reports from the Chief Financial Officer on Finance and Investor Relations; the Chief Operating Officer on Health and Safety, ESG and risk management; the Chief Business Officer on Commercial CDMO activities; the Chief Innovation Officer on new technologies and the innovation roadmap; the Chief People Officer on Human Resources; the Site Heads on the Site Operations; local Heads of Quality on Quality and the Vice-President of Information Systems on cyber security and digital strategy.

Board Evaluation

The Board complies with the UK Corporate Governance Code guidance that a Board evaluation should be externally facilitated at least every three years. During the year, the annual evaluation of the performance of the Board and that of its Committees and individual Directors was undertaken. Quotations were obtained from specialist board evaluation firms and reviewed by the Nomination Committee. The selected evaluator was subsequently invited to present to the Nomination Committee.

The 2024 evaluation was externally facilitated by Beyond Governance, a full service consultancy firm accredited by the Chartered Governance Institute. Beyond Governance has no other commercial relationship with the Group or any individual Director. The Board expects to commission the next externally facilitated review in 2027. The effectiveness review was conducted through engagement sessions with Board members and the Company Secretary. As part of the process, a review of a sample of board materials and governance documentation was completed. Participants were provided with a short web-based questionnaire capturing the key aspects of the operations of the Board including: the Board’s role in strategy setting; Board composition and succession planning; engagement between the Board and the CET; governance

processes, meeting management and the quality of board reporting; shareholder and stakeholder engagement; and the role of the Board Committees.

Beyond Governance prepared a report based on Board members’ responses to the questionnaire and interviews it carried out with each Board member. The report was presented to the Nomination Committee in December 2024 and formed the basis of an action plan presented to the Board to address the findings in January 2025. The action plan identified and addressed, amongst other things, the need for focus on succession planning for the CET and the senior leaders of the Group, as well as addressing engagement with the CET, governance, including reports to the Board from the CET and the Board Committees and the

introduction of the deep dives on various strategic topics.

The effectiveness review demonstrated that the Board is active and engaged in the operations of OXB. Whilst the review identified some areas where there could be enhancements in the operations of the Board to support effective decision making, the Board was judged to be highly functional and operating effectively.

As part of the Board effectiveness review, each Director’s contribution to the work of the Board and personal development needs were considered. Directors’ training needs are met by a combination of: internal and external speaker presentations and updates as part of Board and Board Committee meetings; specific training sessions on particular topics, where required; and the opportunity for Directors to attend external courses, should they wish to do so.

Re-election of Directors

In accordance with the articles of association and to ensure compliance with the UK Corporate Governance Code, all Directors are subject to annual re-election.

Diversity and Inclusion

The Group recognises the importance of diversity and is committed to encouraging inclusion, equality and diversity among its workforce. The Group aims to create an inclusive working environment based on merit, fairness and respect to enable it to attract and retain the most talented people from all backgrounds and cultures.

The Group is also working to achieve a diverse Board and its Committees and, just as importantly, diverse management and senior leadership teams. Appointments to the Board and its Committees are based on merit, taking into account suitability for the role as well as the composition and balance of the Board and its Committees at the time, to ensure that the Board and its Committees has the right mix of skills, experience, independence, knowledge and consideration of the Group’s strategic objectives.

The Group believes that members of the Board and the CET should collectively possess a diverse range of skills and expertise and should come from a diverse range of ethnic and societal backgrounds. As at 31 December 2024, the CET excluding the Executive Directors, totalled six, three of which were women. In the gender pay gap report for 2024 (for the full report see the Group’s website www.oxb.com), the population at the CET, Head of Department and senior managers level was made up of 59% females and 41% males, thereby meeting the FTSE Women Leaders Review’s recommendation that 40% of senior leadership roles (defined as the CET and their direct reports) be held by women at the end of 2024. Part of the Group’s strategy will be to maintain and improve on the targets, so that the objectives of the FTSE Women Leaders Review will continue to be met during 2025.

The Board is aware of the recommendations of the Parker Review on Ethnic Diversity (Parker Review). The Parker Review set a target for FTSE 250 companies to have at least one Board member from a minority ethnic background by 2024. Namrata Patel identifies herself from ethnic minority background strengthening and diversifying the Board and aligning the Board’s composition with both the recommendations of the Parker Review and also the recommendation set out in Listing Rule 6.6.6R(9)(a)(iii) that at least one individual of the Board of Directors be from a minority ethnic background.

- Gender Pay Gap Report 2021

- Gender Pay Gap Report 2022

- Gender Pay Gap Report 2023

- Gender Pay Gap Report 2024

- Gender Pay Gap Report 2025

Communication with Shareholders

The Board recognises the importance of effective communication with shareholders and potential investors. The Chair, Vice Chair, Senior Independent Director and Chair of the Remuneration Committee are also available for meetings with investors, if required.

Risk Management

OXB firmly believes that embedding a robust risk management framework across all sites is crucial to ensuring the continued success and sustainability of the organisation. The Group has an established risk management framework focused on risk identification, assessment and evaluation, with specific risks addressed using tailored mitigation strategies. The Group’s risk management framework identifies and assesses risks and appropriate mitigation strategies, ensuring that emerging risks and operational challenges are effectively captured and addressed. Through horizon scanning, emerging risks are identified and subsequently documented in a risk register that captures both operational and strategic risks

along with their corresponding mitigation actions. These risks are then consolidated into a Group risk register that undergoes review by the ESGR Committee before being presented to the CET. The CET bears responsibility for monitoring the effectiveness of these processes. To ensure proper governance, the ESGR Committee provides the Board with a comprehensive risk report as part of its Board materials at each of its formal meetings.

Internal Controls

The Directors are responsible for the Group’s system of internal controls and for reviewing its effectiveness. The system is designed to manage, rather than eliminate, the risk of failure to achieve business objectives and can only provide reasonable and not absolute assurance against material misstatement or loss. At least bi-annually, the Group Financial Controller and the Senior Manager of Financial Controls present to the Audit Committee an update on control activity performed during the year, including financial, operational and compliance controls.

The Audit Committee supports the Board in discharging its responsibilities in relation to whistleblowing, ethical behaviour and the prevention of bribery, fraud and adherence to modern slavery legislation.

Corporate Executive Team

The CET is responsible for the global management of the Group. The CET meets on a bi-weekly basis, with the Site Heads joining every other CET meeting. Operations are covered by the respective Site Leadership Teams (SLTs) in Bedford, MA, US, Lyon and Strasbourg, France and Oxford, UK.

There are four CET sub-committees covering the major business operational areas. These sub-committees meet on a regular basis and are attended by certain CET members and other relevant senior managers from the business. The CET sub-committees are:

• Environment, Social, Governance and Risk Committee (ESGRC) – this new sub-committee combines ESG and Risk Management Committees comprising senior managers from all parts of the business across all OXB sites.

In 2024, OXB undertook significant steps to establish a robust and aligned ESGR governance structure. Central to this effort was a dedicated ESGR workshop, designed to align the Site ESGR Committees with the Group’s organisational strategy. The workshop brought together key representatives from the UK, the US and France to:

◦ Assign individuals to oversee Environment, Social, Governance and Risk aspects within the Site ESGR Committees.

◦ Define the purpose and scope of the Site ESGR Committees.

◦ Align on 2025 objectives and identify priority workstreams for each region.

• Global Technical and Innovation Committee (GTIC) – this sub-committee is authorised by the CET to review all technical and innovation activities associated with the Group’s capabilities, platform technologies and technical innovations across all OXB sites. It is the primary forum for discussing new projects related to the technology / innovation roadmap and making strategic and budgetary decisions on the best uses of OXB resources.

• Intellectual Property Management Committee (IPMC) – this sub-committee comprises senior members of technical and IP teams and is responsible for ensuring the protection of Intellectual Property across all OXB sites.

• Quality Management Review Committee (QMRC) – this sub-committee provides global oversight in relation to quality and compliance across all OXB sites and is supported by more frequent location/site-specific quality forums where each of the sites review quality related KPIs, compliance, etc. to evaluate the overall health of the Quality Management System at the site-level.

Within their area of responsibility these sub-committees set objectives and targets, monitor performance against KPI’s, ensure compliance with GxP and other relevant requirements and monitor expenditure against budget and risk management. Important matters arising from all of these sub-committees are referred to the CET.